Financial

Performance

3

Investments

Total investments in 2024 amounted to €43 million, a reduction compared to the previous year, reflecting the impact of current market conditions. The investments were made across multiple business units, including sustainability initiatives, digital transformation, and infrastructure development.

2024

MILLION

TURNOVER

2024

EBITDA

€65 million

compared to €67 million in 2023.

compared to €603 million in 2023.

Basecamp

Throughout 2024, significant progress was made on the new Den Hartogh Basecamp at Sluisjesdijk in Rotterdam. Construction continued at full speed to transform the site into a sustainable logistics hub. The building is designed with energy efficiency in mind, featuring solar panels, a heat pump, double glazing, underfloor heating, and other sustainable solutions – all reflecting Den Hartogh’s commitment to environmental responsibility.

More than just an office, Basecamp is designed as a hub for connection, collaboration, and innovation. Located in the heart of the port of Rotterdam, alongside the Maas, it will bring together teams from different business units under one roof, encouraging cross-functional teamwork while supporting both current operations and future growth.

Acquisition H&S Group

enhance Den Hartogh's global market position and service offerings. Both companies, sharing a rich history and values, viewed the merger as an opportunity to combine strengths, expand smart logistics solutions, and set new standards in the logistics industry.

In March 2024, Royal Den Hartogh Logistics expanded its portfolio by acquiring H&S Group, a leading European logistics service provider of liquid foodstuffs. This strategic acquisition established H&S as Den Hartogh's fifth business unit, alongside Liquid, Gas, Global, and Dry Bulk. The integration will

INVESTMENTS

Digital Investments (ICT)

Den Hartogh continued its investment in digital transformation to streamline operations and support the SPECE pillars. Key projects included the rollout of a new Transportation Management System (TMS), the expansion of the Den Hartogh Inside app for employee engagement, the enhancement of People & Culture sytems through Workday, and advanced Business Intelligence and Data Analytics capabilities. These investments aimed to improve operational efficiency, decision-making, and talent management across the organisation.

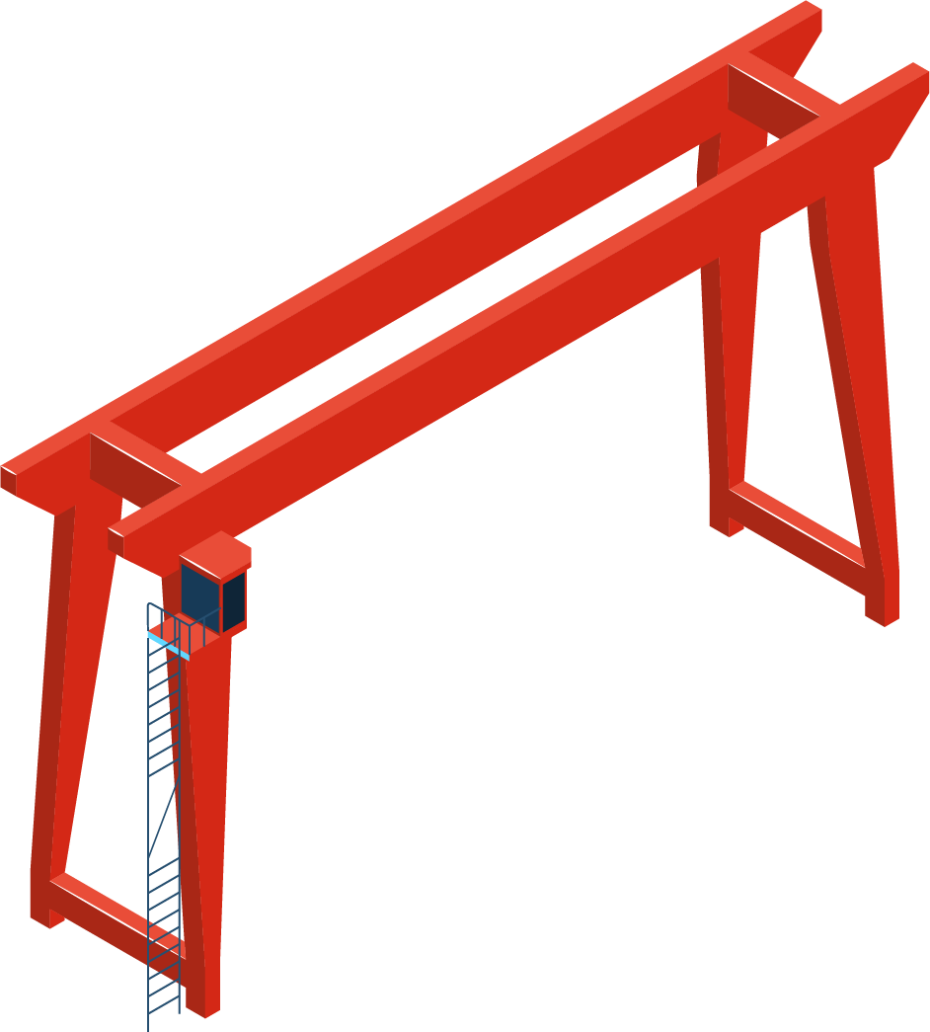

Fleet Investments

Significant investments were made in expanding and modernising the fleet across various business units. In the Global Logistics business unit, 400 additional tank containers were added to meet growing demand, while Dry Bulk received 760 new 30ft bulk containers. The Pressure Tank Fleet of Dry Bulk experienced notable growth to increase focus on speciality chemicals, minerals, and food/feed materials. In Sweden, new electric trucks were delivered, and lightweight trailers were ordered to enhance Gas Logistics operations in the German market.

Network Investments

Den Hartogh invested in new facilities to improve operational efficiency and enhance customer service. Key projects included the opening of a heating facility in Helsinki, Finland, with capacity for eight units and ADR/IMO capability, as well as the expansion of the Alisan-Den Hartogh site in Gebze, Turkey, to support cleaning, storage, heating, and maintenance. The team in Chiasso, Switzerland, relocated to a modern office, while three new offices were established in Indonesia—Jakarta, Surabaya, and Medan—as part of the company’s continued growth in the region.

Further strengthening our presence in APAC, we initiated the setup of Den Hartogh Vietnam, with completion expected in 2025. Additionally, we successfully launched Intra-APAC transport lanes, marking a significant step in expanding international regional transport alongside domestic operations and creating a strong platform for future growth.

Green Investments

Several investments were made to support environmental sustainability goals. Den Hartogh installed a 10,000-liter HVO refueling station in Mortara, Italy, expected to dispense 250,000 liters annually, matching the company's total HVO consumption in 2023. The Gothenburg home base transitioned entirely to HVO, including company cars and logistics center machinery. Electric trucks in Sweden leveraged the clean energy grid, achieving a 93–100% reduction in CO2 emissions. Shell’s megawatt charger was also introduced, enabling rapid electric truck charging. The Book & Claim programme further facilitated sustainable transport initiatives.

We invested in sustainability-related platforms and certifications, including the EcoTransIT system to calculate CO2 emissions using the GLEC framework and the Ship Green Declaration for green shipments. Further investments supported compliance with the Corporate Sustainability Reporting Directive (CSRD) and ISO certifications across multiple business units.

Read more in our Environmental Sustainability Chapter.

Investments

Asia Import Desk

To capture growth in APAC-Europe trade, Den Hartogh established an Asia Import Desk in Rotterdam, staffed with a dedicated customer service team experienced in managing Asian imports. This investment aimed to ensure reliable service, optimise supply chain efficiency, and strengthen collaboration with overseas offices.

BACK TO OVERVIEW

BACK TO TOP

BACK TO OVERVIEW

BACK TO TOP

Digital Investments (ICT)

Den Hartogh continued its investment in digital transformation to streamline operations and support the SPECE pillars. Key projects included the rollout of a new Transportation Management System (TMS), the expansion of the Den Hartogh Inside app for employee engagement, the enhancement of People & Culture sytems through Workday, and advanced Business Intelligence and Data Analytics capabilities. These investments aimed to improve operational efficiency, decision-making, and talent management across the organisation.

Green Investments

Several investments were made to support environmental sustainability goals. Den Hartogh installed a 10,000-liter HVO refueling station in Mortara, Italy, expected to dispense 250,000 liters annually, matching the company's total HVO consumption in 2023. The Gothenburg home base transitioned entirely to HVO, including company cars and logistics center machinery. Electric trucks in Sweden leveraged the clean energy grid, achieving a 93–100% reduction in CO2 emissions. Shell’s megawatt charger was also introduced, enabling rapid electric truck charging. The Book & Claim programme further facilitated sustainable transport initiatives.

We invested in sustainability-related platforms and certifications, including the EcoTransIT system to calculate CO2 emissions using the GLEC framework and the Ship Green Declaration for green shipments. Further investments supported compliance with the Corporate Sustainability Reporting Directive (CSRD) and ISO certifications across multiple business units.

Read more in our Environmental Sustainability Chapter.

Network Investments

Den Hartogh invested in new facilities to improve operational efficiency and enhance customer service. Key projects included the opening of a heating facility in Helsinki, Finland, with capacity for eight units and ADR/IMO capability, as well as the expansion of the Alisan-Den Hartogh site in Gebze, Turkey, to support cleaning, storage, heating, and maintenance. The team in Chiasso, Switzerland, relocated to a modern office, while three new offices were established in Indonesia—Jakarta, Surabaya, and Medan—as part of the company’s continued growth in the region.

Further strengthening our presence in APAC, we initiated the setup of Den Hartogh Vietnam, with completion expected in 2025. Additionally, we successfully launched Intra-APAC transport lanes, marking a significant step in expanding international regional transport alongside domestic operations and creating a strong platform for future growth.

Fleet Investments

Significant investments were made in expanding and modernising the fleet across various business units. In the Global Logistics business unit, 400 additional tank containers were added to meet growing demand, while Dry Bulk received 760 new 30ft bulk containers. The Pressure Tank Fleet of Dry Bulk experienced notable growth to increase focus on speciality chemicals, minerals, and food/feed materials. In Sweden, new electric trucks were delivered, and lightweight trailers were ordered to enhance Gas Logistics operations in the German market.

Basecamp

Throughout 2024, significant progress was made on the new Den Hartogh Basecamp at Sluisjesdijk in Rotterdam. Construction continued at full speed to transform the site into a sustainable logistics hub. The building is designed with energy efficiency in mind, featuring solar panels, a heat pump, double glazing, underfloor heating, and other sustainable solutions – all reflecting Den Hartogh’s commitment to environmental responsibility.

More than just an office, Basecamp is designed as a hub for connection, collaboration, and innovation. Located in the heart of the port of Rotterdam, alongside the Maas, it will bring together teams from different business units under one roof, encouraging cross-functional teamwork while supporting both current operations and future growth.

Acquisition H&S Group

In March 2024, Royal Den Hartogh Logistics expanded its portfolio by acquiring H&S Group, a leading European logistics service provider of liquid foodstuffs. This strategic acquisition established H&S as Den Hartogh's fifth business unit, alongside Liquid, Gas, Global, and Dry Bulk. The integration will enhance Den Hartogh's global market position and service offerings. Both companies, sharing a rich history and values, viewed the merger as an opportunity to combine strengths, expand smart logistics solutions, and set new standards in the logistics industry.

INVESTMENTS

3

Financial

Performance

Total investments in 2024 amounted to €43 million, a reduction compared to the previous year, reflecting the impact of current market conditions. The investments were made across multiple business units, including sustainability initiatives, digital transformation, and infrastructure development.

Investments

2024

MILLION TURNOVER 2024

EBITDA

€65 million

compared to €67 million in 2023.

compared to €603 million in 2023.